ESG Criticism: 3 Reasons ESG is Getting a Bad Rap

What’s the deal with ESG? It was once seen as the future. But now… it’s getting criticized. In this blog, we decode ESG criticism and dive into the reasons ESG is getting a bad rap.

October 31, 2023

ESG was seen as the future. But now ESG criticism has taken the main stage. From accusations about “woke capitalism” to claims of greenwashing, there are a few key players (each with their own agendas) criticizing ESG analysis. In this blog, we’ll decode ESG criticism and dive into the many reasons why ESG is getting a bad rap.

Let’s get started!

What is ESG?

ESG = environmental, social, governance. It represents a comprehensive approach to evaluating the sustainability and social impact of companies and investments.

- Environmental: focuses on waste management, energy usage, carbon footprint, water conservation, and biodiversity preservation as well as climate change risks and the integration of sustainable practices into operations and supply chains. When we think of corporate sustainability or stakeholder capitalism, most people think of the “E” of ESG!

- Social: impact on society, employees, customers, and communities – including labor practices, data privacy, diversity and inclusion, human rights, and product safety

- Governance: the structures and processes that guide a company’s decision-making and accountability

In short, ESG is a paradigm shift in the way companies and investments operate – focusing more on people and planet than exclusively profit. There are, of course, a ton of business benefits as well, like risk mitigation.

You can get the full scoop on ESG in our blog here!

Fast Facts

- There was $2.5 trillion in ESG funds at the end of 2022

- ESG investing began in the 1960s and has gained traction since then

- 88% of companies have ESG initiatives in place (NAVEX Global)

- About two-thirds of privately owned companies have ESG initiatives (NAVEX Global)

- 13% of investors globally see ESG as a “passing fad that will eventually go out of fashion” (Capital Group)

- Most ESG fund assets are held in Europe. In Europe, sustainable funds account for 20% of overall fund assets… and are expected to increase.

- 66% of Gen Z investors said they were very concerned about social and environmental issues, while 66% of investors over age 58 said they were “somewhat or not at all concerned” abouts social and environmental issues (Stanford University)

ESG Criticism

There are opinions on all sides when it comes to ESG approval and criticism. We’ve gathered some of the recent “controversy” around ESG for you. Keep in mind – everyone tackles this issue with a slightly different point of view.

At Karma Wallet, we see the value ESG has for corporate responsibility. But we also acknowledge it isn’t a fix-all for the issues facing our world.

Let’s dive in!

Lofty Expectations and Inevitable Disappointments

Because of the hype around ESG, there were some high expectations associated with it. Both proponents and critics thought it was going to change the world. But many years in, it has disappointed both sides.

ESG investors do include non-financial factors in their decision making process – factors that benefit the health of society and the environment. But… ESG does not prevent them from also purchasing the stocks of fossil fuel companies.

ESG investing also does not contribute essential capital to funding solutions to avoid the worst impacts of climate change.

Therefore, some consider ESG an ineffective tool and slightly disappointing. It does not fund essential solutions, and does not prevent other investments that contradict ESG initiatives.

While ESG criteria can drive corporate responsibility and sustainability, it might fall short of being the panacea for more complex environmental and social issues.

Political Backlash and The War Against “Woke” ESG

Some critics say that ESG investments allocate money based on political agendas, rather than the best returns, calling it a “woke financial scam”.

They state ESG investing has been co-opted by political ideologies, leading to decisions that are more driven by social and political factors than sound financial analysis.

Florida governor Ron DeSantis announced legislation to protect Floridians from “the woke environmental, social, and corporate governance (ESG) movement that continues to proliferate throughout the financial sector”. He states that ESG metrics only serve the companies that created them, and “implement a radical ideological agenda”.

As such, he’s proposed legislation to stop Florida’s public pension fund from considering ESG factors when investing its assets. Ron DeSantis has also famously rejected human-caused climate change.

On the other hand, the ESG Working Group of the Financial Services Committee condemns “progressive activists who are using our institutions to force far-left ideology on Americans”.

ESG investing should primarily focus on assessing the sustainability and ethical impact of investments rather than advancing a particular social or political narrative. Thus, the intertwining of ESG and political debates has led to a fair share of skepticism and criticism.

Before ESG was co-opted for political reasons, it was designed to be a straightforward investment strategy for companies. It aimed to do 2 things: measure and evaluate nonfinancial factors to enhance shareholder returns, and help with the sustainable development of global society.

By 2022, global ESG funds had over $2.5 trillion in assets.

ESG Greenwashing and Lack of Standardization

Another complaint against ESG is the efficacy of ESG investing in achieving its intended goals. Critics argue that ESG metrics often lack standardization, leading to inconsistent evaluations of companies’ environmental, social, and governance practices.

Inconsistent metrics can make it difficult for investors to make informed decisions, potentially leading to misallocation of resources.

There are also complaints of greenwashing, where companies overstate their ESG achievements to attract investors. This form of manipulation can undermine the credibility of ESG investing.

To better improve ESG overall, there must be a standardization of ESG metrics to ensure that the assessment of companies‘ ESG practices is more accurate and reliable.

Without such standardization, ESG investing may be seen as an unreliable and ineffective approach to sustainable investing.

Why ESG Isn’t Going Anywhere

Now that we’ve taken a look at the criticism of ESG, let’s talk about why ESG isn’t going anywhere.

- ESG Offers a Better View of Risk: assessing risk is a critical part of investing. ESG information provides a more clear picture of that risk, and gets to issues that matter including brand and reputation, treatment of workers, pollution, etc. In fact, 82% of US-based asset managers systematically include ESG information in their investment process, according to a Russell Investments survey of asset managers.

- Stakeholder Capitalism Is Good for Companies: in stakeholder capitalism, the needs of a variety of stakeholders are considered – not just shareholders. By integrating this principle, companies are attracting more talented workers AND more loyal customers. Simply put, it’s good for business.

- ESG Regulations: as more regulations and enforcements appear around ESG, there are improvements in the overall process. These regulations force asset managers and companies to be more clear with how they’re achieving their sustainability and social impact goals. In short, ESG is getting more standardized, which is a good thing.

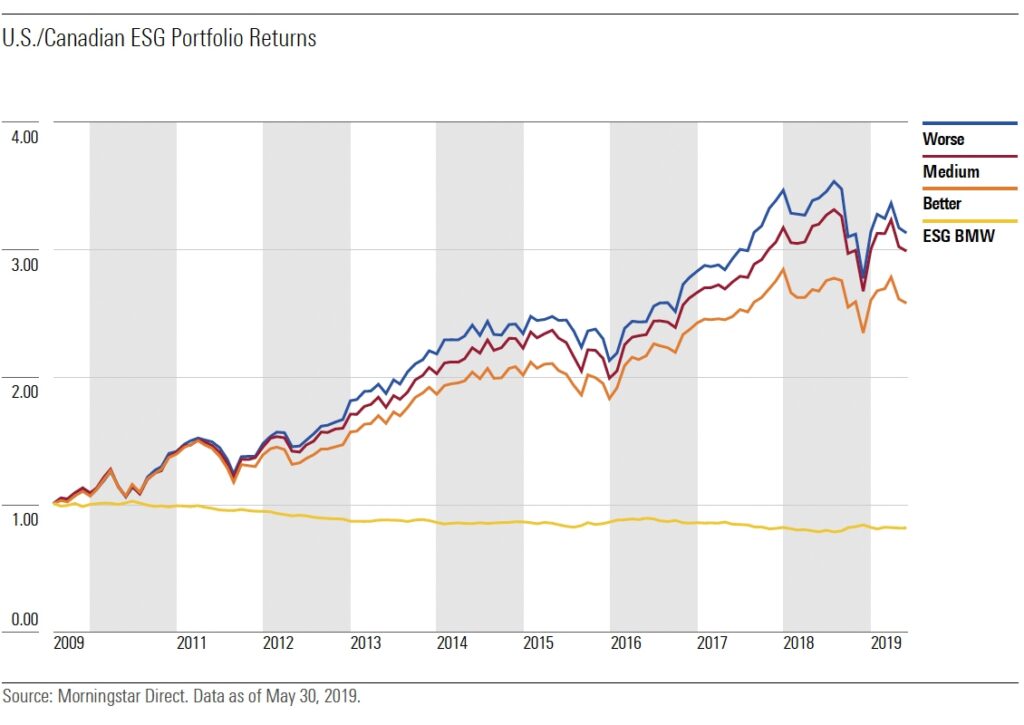

- On Par Returns: ESG funds are performing on par with traditional funds, so it’s unlikely that they’ll be going anywhere.

TLDR: ESG Criticism and What’s Next

ESG, and the controversy around ESG, has gotten a lot of attention as of late. As we’ve shown, there are some real reasons to be skeptical of ESG. But… there is also a lot of noise that we don’t feel like ESG deserves.

At the end of the day, we think that ESG can be a useful and powerful tool for companies to create impact. But, there is more that must be done to tackle the climate crisis, both from companies and individuals and governments.

Long story short, ESG analysis and sustainable investing aren’t going anywhere.

We should work to continually improve the ESG process, while taking into account other strategies and tools to help our planet and the people on it. It is essential to recognize that ESG investing is still evolving and has the potential to drive positive change in the corporate world.

What do you think about the criticism of ESG? Let us know in the comments!